The Commercial Real Estate industry

The Commercial Real Estate (CRE) industry is highly diverse, with a wide range of organisational sizes and business models. Some CRE companies own buildings, others manage a portfolio of built assets on behalf of other customers.

But in the wake of COVID, the CRE industry as a whole has been feeling the pressure. Building usage patterns have changed beyond recognition. There are new regulations around health and hygiene and many tenants, particularly in retail and hospitality, have faced bankruptcy.

The challenge; inefficiencies, waste

This is all the more challenging in an industry that has struggled to innovate and leverage technology. Over $100 billion is invested in Australia’s buildings and infrastructure every year. Of this, around $15 billion is wasted. The primary cause is poor data management. Critical information collected about assets and infrastructure gets lost and forgotten instead of centralised, used and analysed.

At a time like this, leveraging data, working smarter and finding efficiencies and cost savings is critical. To stay relevant and add value, CRE companies need to look beyond basic FM and operational expenditure (OPEX) to how they can generate insights for their customers that will influence CAPEX. To do this they need a better understanding of asset value and lifecycle costs, and gain a more holistic and longer-term view.

Leveraging data

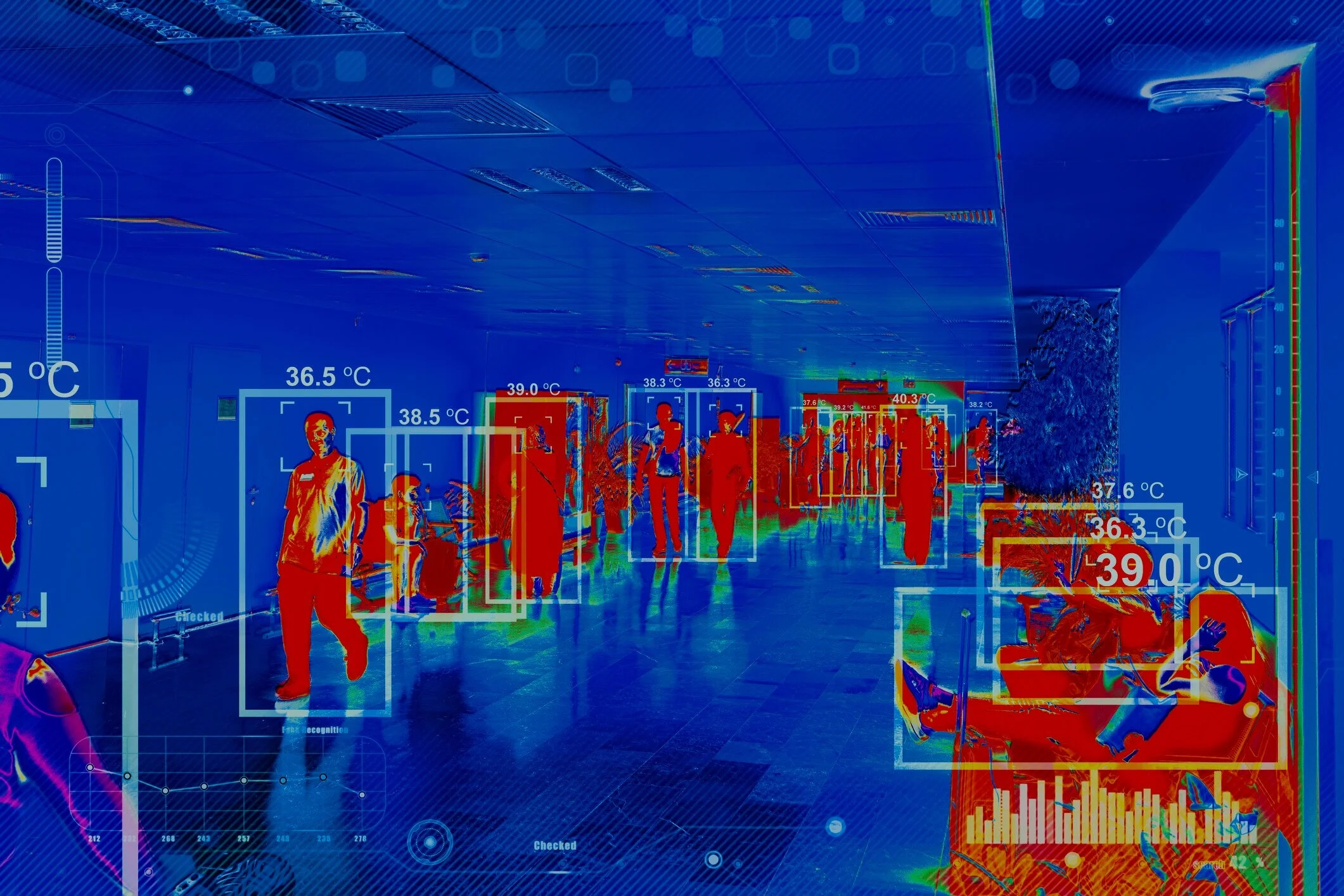

To achieve this, a new approach is needed. The traditional reactive approach to asset management (troubleshooting problems as they occur) results in equipment failures, expensive downtime and potential legal costs. Instead, CRE firms are moving to a preventative and predictive approach, using data to gain a better understanding of assets and anticipate issues before they occur and escalate.

By embracing a data-driven asset management strategy, our customers in CRE are driving outcomes for their own customers. By using asset intelligence, CRE companies can get clear insight into capital expenditure (CAPEX) investments and a longer-term view for the client.

AssetFuture is all about asset intelligence: the merging of data, information, and technology to forecast the lifecycle of built assets. It enables robust decision-making and successful business outcomes. Starting from data acquisition, the platform provides transparency with intelligent classification, virtualisation, and predictive modelling of asset lifecycle. Using customisable dashboards, asset managers can much more easily control maintenance costs, plan capital spending, and develop future asset strategy.

The outcome; cutting costs, driving profits

CRE companies who have used AssetFuture to gain asset intelligence have enjoyed significant cost savings as well as other benefits. Optimising asset management and maintenance frees up capital and relieves staff from often burdensome administrative tasks, allowing them to focus on higher value work and building new and existing client relationships.

“By deploying AssetFuture, we’ve been able to identify and replace critical assets that were nearing end-of-life, avoiding potential failure that can have very serious consequences, legally and reputationally”

“Having a proper Asset Management Plan cut our management spend from $250k to just $12k. There has been a huge time saving in terms of admin and maintenance hours, and we have much clearer insight into costs”

“With the new system that AssetFuture introduced, collecting new data was incredibly fast - it took just eight days. They filled in the gaps very professionally with all the missing data we needed. It puts us in a much better position to develop our Asset Management Plan, and helps us with compliance with the various healthcare maintenance standards”

McKinsey estimates that optimised asset management could save $400 billion worldwide a year. It predicts that a global 60% increase in infrastructure productivity is possible and could save $1 trillion a year through 2030. Currently, global infrastructure spending is estimated at $2.5 to $3 trillion a year, only half of the $6 trillion needed to meet demand to 2030.

The opportunity

Moving to AM is a progression. CRE companies need to use existing FM standards to move towards AM ISO standards, as the standards complement each other. AssetFuture can help organisations make the transformation to asset intelligence and educate their customers and tenants on the benefits.

Ultimately asset intelligence drives efficiencies, lowers operational costs and ensures much higher safety, compliance and uptime. It builds trust with customers and enables lifecycle cost modelling, looking beyond FM and OPEX to a total expenditure (TOTEX) view that incorporates operational and capital expenditures.