AssetFuture had the privilege of participating in the 2025 World Engineers Summit (WES) in Singapore, joining global leaders, engineers, and policymakers to discuss how our profession must evolve to meet the defining challenges of our time. As part of the programme, our CEO, Domenic Fonte, joined C&W Services’ Chief Engineer, Ho Chee Kit, who delivered an energetic presentation followed by a panel discussion focused on a central question: how can predictive asset intelligence help engineers drive resilience, sustainability, and long-term value across Asia Pacific?

From builders to strategic enablers

A recurring theme throughout the Summit was the changing role of engineers. Traditionally, our profession has been defined by problem-solving and delivery, which includes designing, building, and fixing assets when issues arise. While those skills remain essential, they are no longer sufficient on their own.

Increasingly, engineers are being called upon to act as strategic enablers. This means stepping back from day-to-day firefighting and using data, systems thinking, and lifecycle insight to proactively shape outcomes. When operational issues are identified early – or prevented entirely – engineers gain the capacity to focus on innovation, performance optimisation, and sustainability initiatives that deliver value well beyond asset uptime.

Predictive asset intelligence in practice

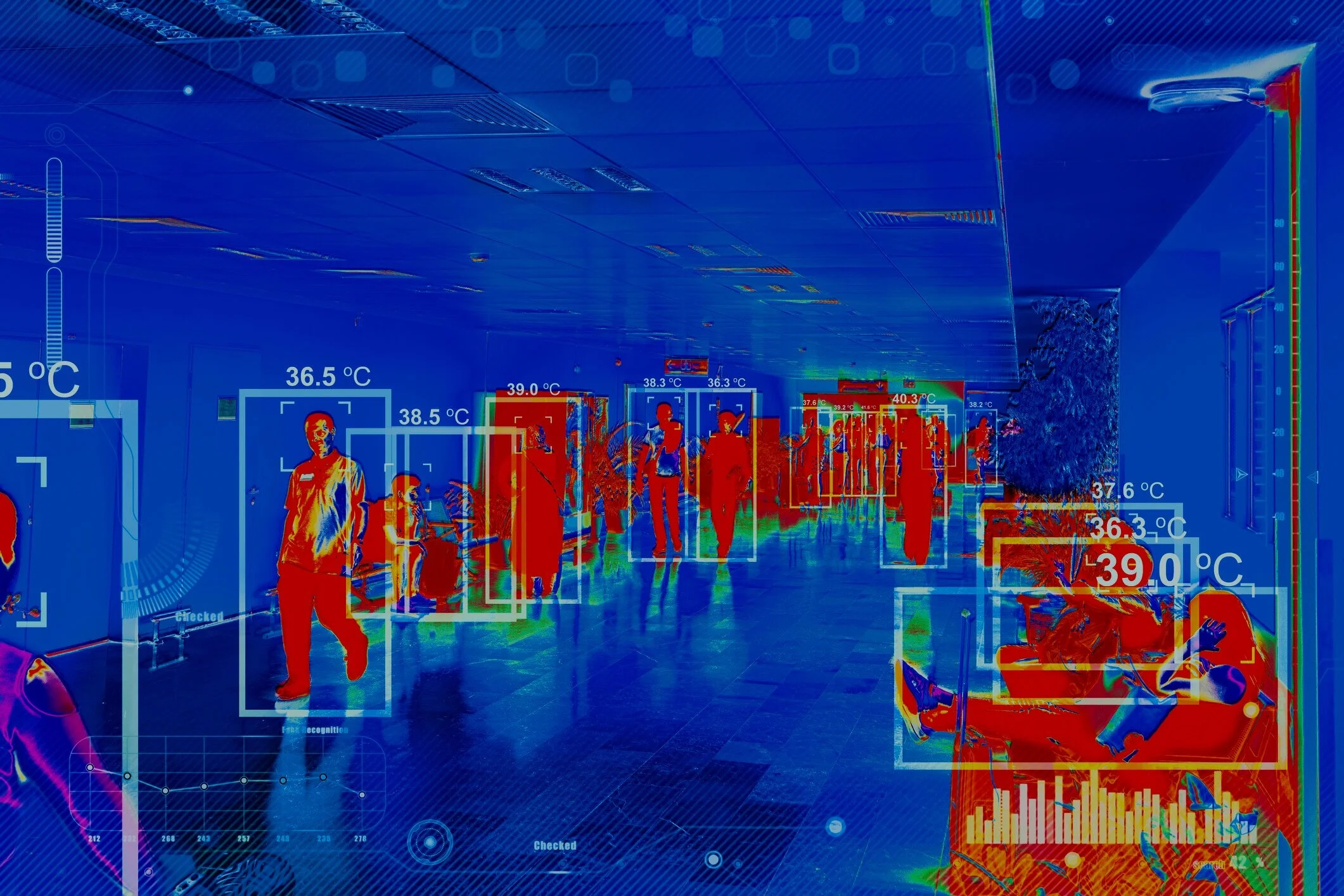

The presentation explored the concept of predictive asset intelligence - the use of advanced modelling, machine learning, and lifecycle forecasting to move organisations from reactive maintenance to proactive stewardship.

When underpinned by accurate asset data and robust engineering logic, predictive approaches help organisations reduce whole-of-life costs, improve reliability, lower carbon emissions through better-timed interventions, and make risk‑informed investment decisions aligned with long-term objectives. Crucially, this is not about replacing engineering judgement with algorithms, but about using AI and analytics as a co‑pilot that frees engineers to focus on strategic decision-making and safe scenario testing before committing capital.

Thinking in data, not just using data

One of the most insightful moments from the panel discussion centred on the difference between organisations that use data and those that think in data.

In data-mature organisations, insights are not treated as static reports. Teams are motivated to continuously improve the quality, accuracy, and relevance of the underlying models. Data is allowed to challenge assumptions, not simply confirm existing beliefs. This mindset shift, supported by disciplined asset registers and validated datasets, is what turns dashboards into decision engines.

When organisations think in data, predictive intelligence becomes embedded in how they plan, budget, and prioritise, rather than sitting alongside operations as a separate digital initiative.

Systems thinking and collaboration

Infrastructure does not exist in isolation. Energy, water, transport, and digital systems are deeply interconnected, and resilience depends on how well those connections are understood and managed.

Predictive resilience requires collaboration between engineers, data specialists, asset managers, and policymakers. Breaking down silos and adopting systems thinking allows organisations to transition from human-centric processes to systems-centric approaches, ensuring continuity even as people and roles change over time.

Looking ahead to 2030

As we look toward 2030, the defining capability for successful engineers will not be a single technology, but the ability to translate organisational objectives into resilient, data-driven systems. Engineers of the future will design frameworks that dynamically balance cost, risk, and carbon, supported by digital intelligence but grounded in engineering logic.

Circular and regenerative models prioritising re-use, retrofit, and recycling are already technically achievable. The challenge now is scaling proof into practice. Pilot projects, clear success criteria, and leadership commitment will be critical to demonstrating that sustainability is not just good for the environment, but good business.