Australia’s health care system ranks well compared to other OECD countries in terms of life expectancy with both male and female life expectancy being in the best third according to the Australian Institute of Health and Welfare.

One of the big factors in this is Australia’s emphasis on prevention and health management, but there is still room for improvement. Australia’s system is a hybrid model where the government provides funding for basic coverage and privately funded health insurance can be sought to provide additional coverage.

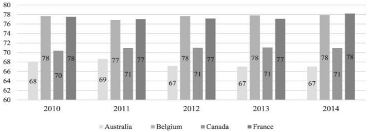

Of four countries with similar hybrid systems, Australia had the lowest public health expenditure compared to the overall health expenditure during the period 2010–2014 as illustrated in the diagram below:

Source: “A review of the Australian healthcare system: A policy perspective”, SAGE open Medicine, 12th April 2018.

Mandatory public health insurance, known as Medicare, is funded by an income tax levy at the rate of 1.5% of each person’s income or 2.5% if the individual or family has not purchased private health insurance. Medicare makes payments to hospitals through the states and territories, and payments to doctors and some health professionals for services provided. This funding is supplemented by federal government budget.

Hospitals

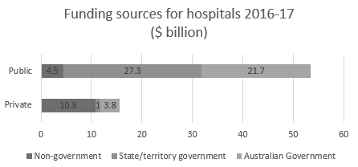

Public hospitals account for 47.3% of health services revenue while Private hospitals account for 10.5% as illustrated in the diagram below:

Products and Services Segmentation (2018-19)

There were 693 public hospitals and 657 private hospitals in Australia in 2017-18

The government funded a total of 92% of public hospital services and only 31% of private hospital services in 2016-17.

Hospital Beds

Public hospital bed numbers rose by an average of 1.3% each year between 2013–14 and 2017–18 to 62,000 beds. This is only about one third the rate of average annual increase in hospitalisations in the public system over the same period. Private hospital bed numbers rose by an average of 3.6% each year between 2012–13 and 2016–17 to 34,300 beds.

In 2017–18, Australia had a total of 3.9 beds per 1,000 population in public and private hospitals.

That’s compared with an average of 4.7 beds per 1,000 population for countries analysed by the Organisation for Economic Co-operation and Development (OECD) and ranked in the middle of the 35 OECD and other selected countries.Whilst this may seem to compare favourably, the accessibility of beds is not reflected in these numbers based on geographic location of the beds in relation to the prevalence of diseases and injuries requiring these beds.

Pressures On The Health Care System

Aging Population Pressures

As health care in general is continually improving, the ratio of the people in the workforce to the number of people on the pension will gradually decrease. This will inevitably lead to further pressure on the ability of the government to fund health care needs.

Source: AIHW, Australia’s health 2018. Chapter 3.14. Canberra: AIHW, 2018.

The implication of the aging population is two-fold. Older patients will require higher levels of care and will become more likely to have multiple health conditions to deal with. Chronic diseases are becoming more prevalent, which often require hospital care to manage such illnesses. Terminal illness, more prevalent in the elderly often requires palliative care, which mainly takes place in hospitals. This graph illustrates the projected age of the Australian population.

Rise in Obesity Rates

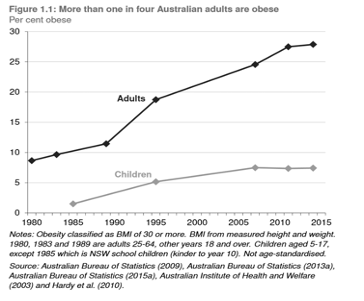

Another issue is putting pressure on the health system is the rising obesity rates in Australia. This graph illustrates the rise in obesity percentage in adults and children over a period of 35 years.

This unfortunate statistic has led to increased incidence of cardiovascular disease (mainly heart disease and stroke), type 2 diabetes, musculoskeletal disorders like osteoarthritis, and some cancers (endometrial, breast and colon). These conditions can lead to the need for hospital care.

Environmental Factors

Modelling conducted by PwC found that the direct cost of obesity in Australia in 2011-12 was $3.8 billion. Direct costs included GP visits, allied health and specialist’s visits, hospital incurred costs, pharmaceuticals and weight loss interventions.

Adding to this burden on the health system is the indirect costs to the economy including absenteeism, presenteeism, disability payments, forgone earnings and taxes and unemployment.

These indirect costs were modelled to be $4.5 billion in 2011-12 making it more difficult for the Government to support this significant and growing problem.

In addition to hospitalisation there is an increase in Other Key Areas to consider

Spend on pharmaceuticals due to increased admission or dosage

Cost of equipment to manage overweight people such as beds, wheelchairs and walkers

Hospital staff injury caused when helping patients with mobility

Much research has been undertaken to quantify the impact that the environment has on patient outcomes whilst in hospital. Some of the more documented environmental factors include:

Excessive heat exacerbating the effects of air pollution and increase the risk of biological hazards.

A 0.9% increase in mortality for every 1 degree Celsius increase in maximum temperature in Sydney. This affects elderly people in particular as they have a reduced ability to regulate body temperature.

Climate change is said to lead to an increase in temperature related deaths by as much as 10% in Queensland and the Northern Territory by the end of the century.

Low UVR exposure can cause vitamin D deficiency which is associated with rickets and osteoporosis.

Poor building ventilation and chemical and biological contaminants can lead to Sick Building Syndrome (SBS) which is known to cause headaches, irritation of eyes, nose or throat, dry and itchy skin, dizziness and nausea, difficulty concentrating and fatigue.

Dampness and mould can increase respiratory and asthma related health outcomes by 30-52%.

Government Strategies to Deal With These Pressures

While 70% of funding is coming from the Government, it started to push back on the rising pressures by:

Implementing a Medicare rebate freeze in 2012 to limit Government sourced revenue

Providing tax incentives for people taking out private health insurance to reduce the load on the public system

Introducing State Government-wide requirements to apply good asset management practices and manage costs appropriately

Medicare Rebate Freeze

The Labour Government first introduced the Medicare rebate freeze in 2013 as part of a temporary $664 million budget saving. Then, on being elected, the Liberal Government froze the Medicare rebate starting July 2014 and then extended the freeze until 2020.

However, since 2017 there has been a phased lifting of the freeze for GP bulk-billing incentive payments (July 2017), standard GP consultations and other specialist consultations (July 2018), medical procedures (due July 2019) and targeted diagnostic imaging services (from July 2020).

While providing some relief to GPs, the easing of the rebate freeze has done little to support the rising costs associated with the hospital system. It has also led to an increase in patient out-of-pocket expenses in some cases.

Private Health Insurance Tax Incentive

The Australian Government has a number of mechanisms to encourage the public to take out private health insurance and reduce the load on the public system. The two most common mechanisms are the Private Health Insurance Rebate and the Medicare Levy Surcharge.

The Private Health Insurance Rebate is designed to make private health insurance more affordable for all Australians. It is means tested in order to provide a premium rebate for those individuals and families in most need.

Similarly, the Medicare Levy Surcharge encourages high income individuals and families to take up private health insurance by reducing income tax if privately covered.

Combined, these two mechanisms aim to relieve the pressure on the public health system by seeking alternative funding for the private system.

Read our more on this topic in our blog post about how AssetFuture can give you confidence in your healthcare facility.